long term care insurance washington state tax opt out

You will not need to submit proof of coverage when applying for your. Time has run out.

-1.jpg?width=565&name=WA%20Trust%20Act%20Tax%20(based%20on%20salary)-1.jpg)

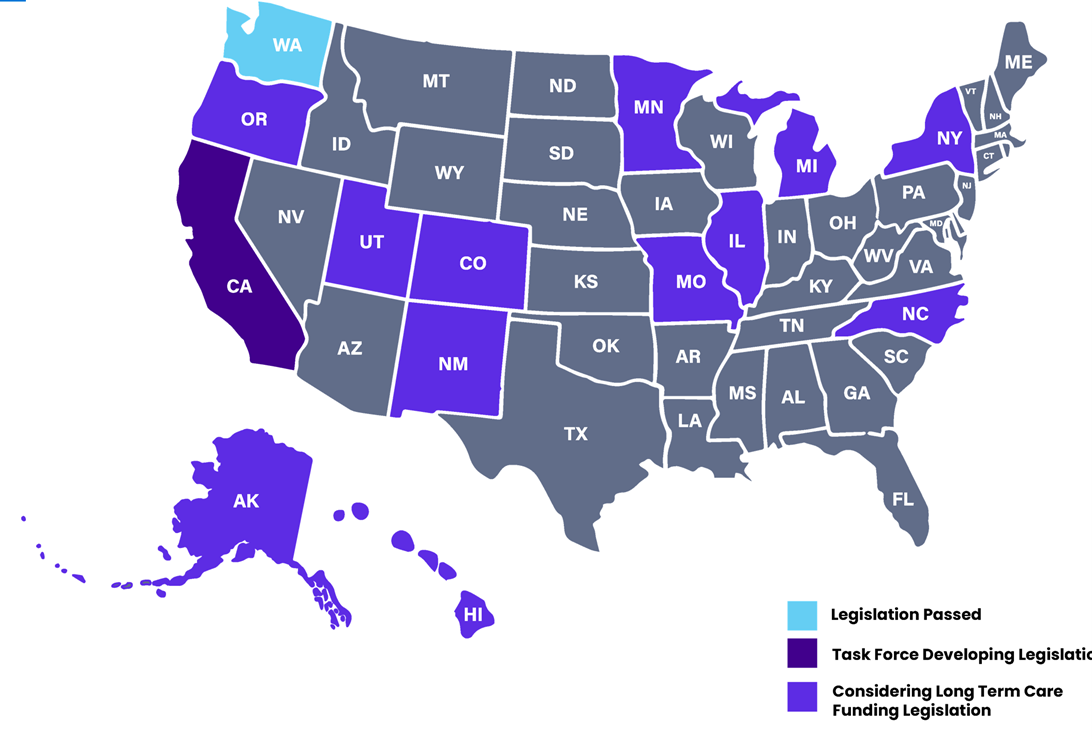

Washington State Is Creating The First Public Ltc Plan Who S Next

Back in 2019 the state passed a law to fund a public long-term care program through a mandatory payroll tax on every W-2 employee.

. Employees have until November 1 2021 to buy long term care insurance to. For example if someone earns 100000 they. People who work in Washington will pay 058 of their earnings into the Washington Cares Fund.

The State of Washington has passed a Payroll Tax to fund long term care insurance programs in Washington State. The Window to Opt-Out. 26 2021 inviting passersby to come in and ask questions about.

A sandwich board sits outside an insurance brokers office in Seattles Fremont neighborhood on Aug. There is no indication. Applications are available as of October 1 2021.

But if you want to opt out you may have some trouble. About 450000 Washingtonians purchased long-term care insurance before November 1st 2021 and opted out of the program. You must also currently reside in the State of Washington when you need care.

Lets assume for the. Workers who wish to apply for an exemption because they hold a long-term care insurance plan purchased by Nov. The 058 payroll tax is based on total earned income meaning that higher earners will pay thousands each year.

Here is a summary of the bill. You needed to apply earlier to have coverage in place by. It is too late to Buy LTC insurance to avoid the Washington Long Term Care Tax.

To qualify for an exemption you must be at least 18 years old and have proof of an eligible LTC. How do I opt out of WA cares. You can design your policy to have substantial daily benefits 400-500Da for years or even unlimited versus the 100day for 1 year for maximum of 36500 that is provided by the State.

This means that if you purchased a private long-term care policy that you should not cancel it. It is too late. Employees now have until November 1 2021 to purchase long-term care insurance if they wish to opt out of the Washington State Long-Term Care.

1 2021 must still apply by Dec. An employee tax for Washingtons new long-term care benefits starts in January. Washingtons new long-term care.

Update April 16 2021. 400day for 5 years is 730000. You have one opportunity to opt out of the program by having a long-term.

When we discussed What You Need To Know About Washingtons New Long Term Care Tax we mentioned three basic options available to Washington employees. The only exception is to opt out by purchasing. The Washington law allowed those with qualified LTC coverage to opt out and avoid the payroll tax but residents were given a short period of time after the law was enacted to secure a qualified LTC policy.

Up until the law was changed in March 2022 the only workers in Washington who were exempted from the program were those who owned long-term care insurance with an effective date prior to November 1st 2021. By contributing a small amount from each paycheck while were working we can all pay for long-term care when we need it. Those choosing not to participate in the long-term care tax needed to have a long-term insurance plan in place by 1112021 if they wish to opt-out.

The tax has not been repealed it has been delayed. LONG-TERM CARE INSURANCE Under this law individuals will. First to opt out you need private qualifying long term care coverage in force before November 1 2021.

Major Changes To Washington State S Long Term Care Program Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Washington State Long Term Care Trust Act 0 58 Payroll Tax 36 500 Lifetime Maximum Benefit Page 11 Bogleheads Org

Long Term Care Insurance Explained Nerdwallet

Washington Long Term Care Tax How To Opt Out To Avoid Taxes

Private Long Term Care Insurance All But Impossible To Get Ahead Of New State Tax Mynorthwest Com

Washington S Long Term Care Program Wa Cares Survives Another Challenge The Seattle Times

Did You Receive A Long Term Care Email From Your Employer Here S What It Means To Opt In Or Opt Out Geekwire

Washington State Long Term Care Tax Wa Cares Fund

What Happened To Washington S Long Term Care Tax Seattle Met

A Surprising Reason Why Clients May Want To Buy Ltc Insurance Now

Time To Opt Out Of New Washington State Ltc Insurance Tax Dwindling King5 Com

Home Washington Long Term Care Llc

Hit The Reset Button On Long Term Care Insurance Mandate The Seattle Times

Long Term Care Insurance What You Need To Know Human Resource Services Washington State University

Washington State Long Term Care Tax How To Opt Out

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

Washington Lawmakers Look At Long Term Care Program As Frustration Builds Over Benefits And Payroll Tax The Seattle Times

Updated Get Ready For Washington State S New Long Term Care Program Sequoia